Creating Annuities on The Lightning Network

What are annuities and why do they matter?

An annuity is a financial instrument commonly known to be either sold by an insurance company, or the preferred means of payment of a pension, lottery winnings, or legal settlement. It is a payment structure whereby the buyer exchanges a lump sum for a specified payment on a specified time-scale (e.g. $100 each month) for a specified time-period (e.g. 10 years). Annuities can be immediate or deferred. They can have certain time periods or be life-contingent (e,g. pay out as long as the buyer remains alive, called a single-life annuity, or continue payment to a surviving spouse, called a joint-survivor annuity)

Most agree that the Roman's were first to the annuity party, but some financial archaeologists argue that annuities actually existed in Egypt from 1100 to 1700 B.C. when a prince from someplace called Sint in the Middle Empire created the first annuity payment plan. (1)

Annuities, conventionally, trace their history to 3rd century Rome, where speculators would exchange annual stipends, called "annua". In return for a (liquid) lump-sum payment, an annua would pay the buyer a fixed annual payment for life. The annua were commonly purchased by Roman soldiers.

Given their popularity in pensions and other government entitlements, one might associate annuities with fiat money and dismiss their relevance on a hard money standard like Bitcoin. Tracing the history of annuities back a few millenia should dismiss us of that notion. The desire to ensure that we don't outlive our money is an idea as old as civilization itself. Like all forms of money that humans have developed, annuities can both be a potent tool for cooperation and have the potential to be abused by governments.

In fiat-money societies, which are inherently inflationary, annuities lose their purchasing power each year due to currency debasement. Some governments pay "Cost-of-Living-Adjustments" (COLAs) but any thinking person would realize that COLAs only debase the purchasing power further as the government needs to create more money to pay them. The cycle continues until the annuity eventually only buys a small fraction of what it did at inception.

On a Bitcoin standard, annuities maintain their purchasing power at a minimum due to the capped supply, and increase their purchasing power approximately every four years by a mechanism known as the halving, where the newly created supply of Bitcoin cut in half. As the supply becomes more and more scarce, its purchasing power increases (the opposite of how it works on a fiat standard). It is the authors opinion that on a Bitcoin standard, instead of steadily losing value over time, annuities will pay out declining amounts each epoch to take advantage of the increase in purchasing power.

At the time of this writing, the Bitcoin reward to miners is 6.25 BTC per block and in approximately one year will be cut in half to 3.125 BTC per block, where that reward will persist for 210,000 consecutive blocks until it halves again. The halving is the mechanism that caps the supply of Bitcoin

The Bitcoin network provides ways for individuals to mitigate the risk of outliving their money without considering the structure of an annuity. The simplest way is to send a UTXO to one's self in the future using the "locktime" feature. A person worried about depleting their Bitcoin savings can code a transaction so that it cannot be spent for a specified time or by a specified block height (e.g. 10 years, or 500,000 blocks from now). Another method would be to use hardware like an Opendime which is a USB stick that contains a private key and can be buried or locked in a safe for long periods of time. Compared to what the Romans had, these are crude and primitive tools and may not necessarily placate the discomfort humans have of outliving their savings. Additionally, each of these entail potentially expensive on-chain transactions both to lock the funds to the future, and to eventually spend them.

Annuities can be a primitive tool for cooperation

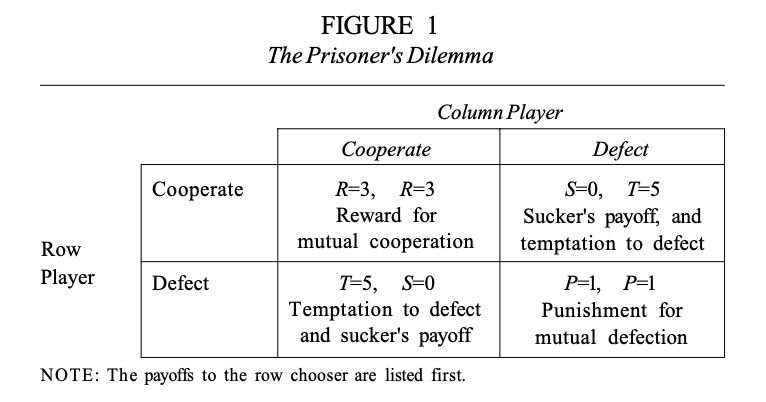

Robert Axelrod's seminal book, The Evolution of Cooperation, describes a nationwide competition to find the best competitive strategies for the Prisoner's Dilemma problem. The Prisoner's Dilemma describes a situation where two parties in a relationship, acting out of mutual self interest, could potentially profit by betraying each other in the short-term, assuming they know the other party won't betray them, but stand far more to gain from long-term cooperation. An example would be two ambassadors for bordering countries. They, and the countries they represent, have a lot more to gain from cooperating in the long term than either one does from betraying the other, especially in the event they both betray each other and their countries go to war. Figure 1, from the book, suggests a scoring system to visualize and sum the accumulated outcomes of a particular strategy.

The revelation from the book stems from Axelrod's explanation of the math that scores a particular strategy. In a given relationship, the payoffs in Figure 1 are discounted by a factor the further out in the future they are. This accurately reflects the fact that people act rationally with a "high time-preference", meaning they always prefer to gain now as opposed to later, all other things equal. The discount parameter (w) is a number between 0 and 1, where the closer it is to 1, the more the future matters, and the higher the overall score. Alternatively, when the discount parameter is close to 0, there is very little incentive for players to cooperate, and game pays off very little.

A couple with no children going through a divorce would have a very low discount parameter, close to zero. They are unlikely to cooperate as they are incentivized to keep as much of their collective wealth as possible. Without the need to raise children together, future decisions are discounted nearly to zero. Put a couple of children in the mix and the discount parameter increases. The younger they are, the higher that discount parameter gets and the battle to split up the assets becomes more civil and cooperative.

An annuity is, in a way, a representation of the prisoners dilemma. The buyer has to lock up funds today to get paid out in the future and trust the seller to make the payments. The two parties seem to rely on the cooperation of the other to market the arrangement happen and the arrangement provides more value to each party than having no relationship at all. The value of the annuity is determined by similarly discounting future expected payments, with the discount parameter representing the interest discount and the probability of default. If the annuity seller is a reputable and regulated insurance company, the probability of default is close to zero and doesn't impact the discount parameter, leaving only the interest rate to impact the discount parameter. A high interest rate means that future payments have a much lower value because it raises the opportunity cost of locking up the lump sum that bought the annuity. This discount lowers the overall cost of the annuity. Conversely, a low interest rate means that the future payments have a higher value (less discounted) and results in a higher lump sum needed to buy the annuity.

The connection between the discount factor as a measure of cooperation versus a measure of interest rates is where the magical connection is between Axelrod and finance. Low interest rates seem to be associated with a high incentives for cooperation, while high interest rates seem to be associated with low incentives for cooperation. The primary components of the interest rate are the rate of inflation and the real growth rate of an economy.

On a Bitcoin standard, the available supply continually decreases as people HODL and lose their coins, while the protocol continues to implement the halvings. With inflation at zero or negative, the interest rate is close to zero even if it is growing modestly in real terms. There is little opportunity cost in Bitcoin due to "yield" and thus, interest rates are zero and the discount factor is close to 1, representing a high incentive for cooperation. Additionally, two peers can use the Lightning Network in a way that removes the risk of default without requiring a regulated insurance company. An annuity can be created on the Lightning network to facilitate cooperation between two peers who wish to have a cooperative financial relationship.

Lastly, it should be noted that a stream of coupons from a bond can, from a financial engineering perspective, be considered an annuity and the value of that annuity is reflected in the value of the bond. From a relationship and cooperation perspective, its an entirely different ballgame because of the counterparty credit risk associated with returning the par value and so bonds don't necessarily offer the same incentives to cooperate as annuities do. Bond sellers are highly incentivized by a world where the future is devalued, where the discount factor is close to zero, and the incentive to betray is unduly strong.

Annuities on the Lightning Network

The Lightning Network is a set of protocols built atop the Bitcoin network that enables a powerful system of worldwide payments that are nearly instantaneous and practically costless. It is possible to create a structure whereby two peers can engage in a cooperative relationship resembling an annuity. Thanks to the properties of Lightning's protocol, it isn't even necessary for the "seller" to provide satoshis on his side of the channel. He can provide goods and/or services without sending a single satoshi back to the other side.

The way an annuity structure would work on the Lightning Network is that the buyer would open a channel with the seller funding his side with an on-chain transaction. One example would be to fund a channel with 5,200,000 satoshis, intended to deliver 100,000 satoshis worth of value every week for a year. A person might set up such a channel with a farmer whom he wants to buy a dozen eggs, a gallon of raw milk, and a 12 oz. rib-eye. He might allow me to lock the cost of the food for the year at 100k satoshis per week.

The farmer might have 20 people that he has this arrangement with, so there would be 20 channels funded and pointed to his Lightning node, with a little over a full Bitcoin committed to him. While he may not be able to access that as capital, a lender could easily see that he has capital committed to him and should consider it towards his creditworthiness. Additionally, the farmer has an annuity coming to him of 2M satoshis per week. He may or may not care about hedging the dollar value but one can potentially see a capital market deriving from such an income stream.

It could be that I show up to the farm, scan a QR code that runs the Lightning protocol that updates the balances of our channels to reflect the value I received. Since my QR code is the only one that can show cryptographic proof that it is I, the owner of that channel and the bitcoin committed to it, perhaps it unlocks my refrigerator with my eggs, milk, and rib-eye, and life on the Lightning protocol is as simple as that! Maybe I stream satoshis to my doctor through my Lightning channel for my visit. Either way, I'm creating a Lightning channel with Bitcoin and receiving the things that I wish to buy without using an intermediary or asking permission.

Eventually, the Lightning Network will be full of farmers, doctors, lawyers, guitar teachers, prostitutes, and all kinds of providers who offer their value in the form of a long term relationship, codified and made official using Lightning. There will be 1-year arrangements, 2-year arrangements, 5-year arrangements, and possibly channels that are meant to stay open and operational in perpetuity. Maybe the farmer indexes the weekly price of eggs, milk, and rib-eye to the halvings and only takes 50K satoshis per week during the next epoch, and so on. Maybe the farmer gets access to capital markets because of the visible commitments to his public node and gets additional funding to expand their operation. Maybe all of the arrangements begin to form a term structure and specific markets in each term begin to develop the price of time in bitcoin.

Either way, it isn't difficult to envision a world where people have value-for-value arrangements in their local communities that facilitate mutual cooperation towards the bright orange future many of us envision is possible with sufficient Bitcoin adoption. Annuities enabled such cooperation from the earliest civilizations to the current fiat nightmares of pensions, healthcare, and social security. They will find a way to continue to do so in a world of hyperbitcoinization. They might even be one of the reasons we get there.